Robust Methodology for Accurate Analytics

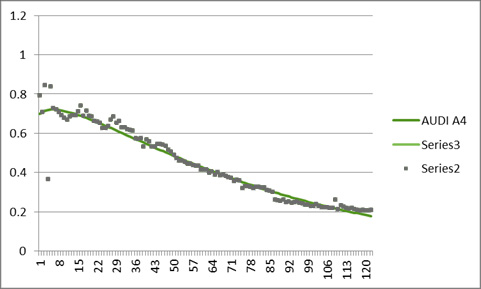

Key to our methodology is the interpretation of the correlation of the price data we have for a vehicle over time. A stronger correlation allows us to provide a more accurate prediction of value and will therefore be shown with a high confidence level.

We attempt to deliver a price based on market activity for a particular vehicle code or Tru – code. We consider the sample size and the coefficient of correlation for each year model of each Tru code. On some occasions the pattern of correlation for the different year models gives different levels of reliability.

Confidence levels

The below graph is an example of where there is a very strong correlation between the raw data values (green dots) and time for the Audi A4. Our predicted values (shown here as a blue line) for this particular model will have a high confidence indicator as there is a very definite trend that can be calculated.

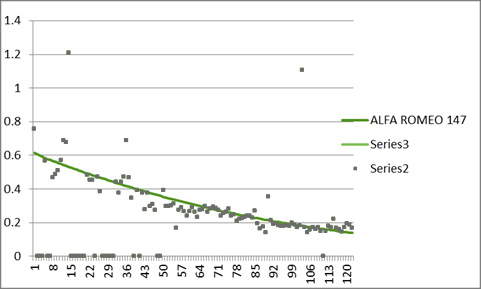

In another example, the Alfa Romeo 147 data set, the raw data values provide a sound trend, despite a few outliers, which allows us to predict current values at a relatively good confidence level.

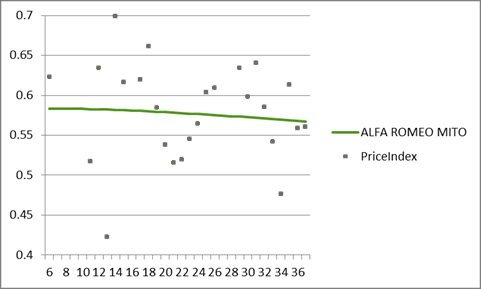

As we drill down to individual model variants with less comprehensive raw data input, the trend becomes less reliable and for values on these particular models our confidence indicator would be lower.

An example of this scenario can be seen in the below graph for the Alfa Romeo Mito. The raw data values are sporadic and unpredictable and result in a trend line that is not indicative of accurate valuation. As we broaden the sample size by becoming less granular, so the confidence rating decreases.